Saint Louis, Missouri-headquartered Post Holdings, Inc., a major player in North America’s ready-to-eat breakfast cereal market, announced on September 19 that it is buying New Albany, Ohio-based Bob Evans Farms for $77 per share. The transaction does not include the Bob Evans Restaurants chain, which was sold to Golden State Capital in April.

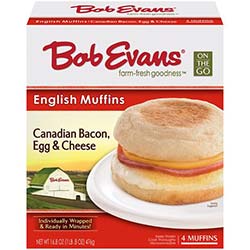

Founded in 1948, Bob Evans Farms is today a leading producer and distributor of refrigerated potato, pasta and vegetable-based side dishes, pork sausage, and a variety of refrigerated and frozen convenience food items under the Bob Evans, Owens, Country Creek and Pineland Farms brands. Its line of frozen retail products includes Canadian bacon, egg and cheese filled English muffins, sausage, egg and cheese burritos, snack size sausage biscuits, and Southwest Breakfast Bakes featuring hash browns and green and red bell peppers.

Founded in 1948, Bob Evans Farms is today a leading producer and distributor of refrigerated potato, pasta and vegetable-based side dishes, pork sausage, and a variety of refrigerated and frozen convenience food items under the Bob Evans, Owens, Country Creek and Pineland Farms brands. Its line of frozen retail products includes Canadian bacon, egg and cheese filled English muffins, sausage, egg and cheese burritos, snack size sausage biscuits, and Southwest Breakfast Bakes featuring hash browns and green and red bell peppers.

The company has a growing foodservice business, which currently accounts for approximately 35% of total volume. Its product range in this sector includes sausage, sausage gravy, breakfast sandwiches and side dishes, which are made to match individual customer specifications.

The addition of Bob Evans’ portfolio of brands and products will significantly enhance Post’s refrigerated side dish offering, provide it with a presence in breakfast sausage segment and secure a solid position in the higher growth perimeter of USA grocery stores. The combination with Bob Evans will also strengthen Post’s presence in the commercial foodservice business and create opportunities for future growth.

The addition of Bob Evans’ portfolio of brands and products will significantly enhance Post’s refrigerated side dish offering, provide it with a presence in breakfast sausage segment and secure a solid position in the higher growth perimeter of USA grocery stores. The combination with Bob Evans will also strengthen Post’s presence in the commercial foodservice business and create opportunities for future growth.

The transaction, which has been approved by the boards of directors of both companies, is expected to be completed in the first calendar quarter of 2018 – which is Post’s second quarter of fiscal year 2018 – subject to customary closing conditions including the expiration of waiting periods under US antitrust laws and approval of Bob Evans’ stockholders.

Upon closing of the deal, Post expects to combine its existing refrigerated retail egg, potato and cheese commercial activities with Bob Evans, establishing a refrigerated retail business within Post, which will be led by Mike Townsley, Bob Evans’ current president and ceo. Jim Dwyer will continue in his current role as president and ceo of the Michael Foods Group, managing the commercial foodservice egg, potato and pasta businesses, which will include the Bob Evans foodservice operations.

Financial Details

The equity value of the transaction is approximately $1.5 billion. The acquisition purchase price represents a 15% premium on the 30-day volume weighted average price of Bob Evans shares. Post expects to finance the purchase with cash on hand and through borrowings under its existing revolving credit facility. Bob Evans will continue its dividend payments in the ordinary course of business pending closing.

The equity value of the transaction is approximately $1.5 billion. The acquisition purchase price represents a 15% premium on the 30-day volume weighted average price of Bob Evans shares. Post expects to finance the purchase with cash on hand and through borrowings under its existing revolving credit facility. Bob Evans will continue its dividend payments in the ordinary course of business pending closing.

Post management expects Bob Evans to contribute approximately $107 million of adjusted EBITDA on an annual basis, which is the midpoint of Bob Evans’ current fiscal year 2018 adjusted EBITDA outlook. This outlook is before the realization of cost synergies that Post management expects to be approximately $25 million annually by the third full fiscal year post-closing, resulting from benefits of scale, shared administrative services and infrastructure optimization. One-time costs to achieve synergies are estimated to be approximately $25 million.