The heat of competition may soon be dialed up even further in the United Kingdom frozen food retail sector, following Brait SE’s purchase of majority ownership in the Deeside, Wales-headquartered Iceland Foods supermarket business. The San Gwann, Malta-based investment company, headed up by South African billionaire Christo Wiese, has increased its shareholding to 57% by acquiring a 37% stake from Lord Kirkham and the Landmark Group of Dubai.

The board of directors at Iceland issued a press release welcoming the “new partnership with Brait,” noting that there has been no change in shareholdings of the company’s executive directors. Together, Chairman and CEO Malcolm Walker, CFO Tarsem Dhaliwal, and Joint Managing Directors Nigel Broadhurst and Nick Canning own the remaining 43% of the equity and retain operational control of Iceland Foods.

“We are absolutely delighted that Brait has underlined its confidence in the future of Iceland by increasing its commitment to our business,” said Walker. “This streamlining of our share register gives us a single, supportive external shareholder with a deep understanding of the challenges and opportunities in UK retailing.”

Brait paid £172 million (approximately $261 million) to consummate the deal. Wiese, whose personal net worth of $7 billion ranks him as South Africa’s richest man according to the Bloomberg Billionaires Index, owns 35% of Brait stock valued at approximately $1.4 billion. He had been keen on increasing investment in Iceland, as the major food retailing multiples have lost market share in Britain’s increasingly competitive environment to deep discounters such as Aldi and Lidl, which now respectively account for 5.6% and 4.1% of UK grocery sales.

The belief in the Brait boardroom is that this development offers of an opening for quality-oriented but budget price-minded Iceland to move ahead as the chain is regarded as “well positioned with its value and proposition for the current and medium-term economic climate prevailing in the UK.”

“I was a little bit shocked when I saw the Tesco numbers. I mean these are horrific numbers,” said Wiese in an interview earlier this year. He was referring to the high street retailer’s record statutory pre-tax loss of £6.4 billion for the fiscal year to the end of February, which compared with an annual pre-tax profit of £2.26 billion a year earlier. It was reportedly the biggest loss sustained by a UK retailer and one of the largest in Britain’s corporate history.

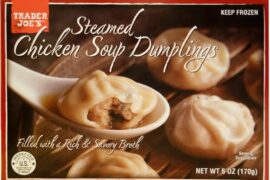

Meanwhile, the latest numbers generated by frozen food retail specialist Iceland were upbeat. Thanks to recent efforts to create a more premium image for frozen food, as well as new store openings including its Food Warehouse format, Iceland is attracting more shoppers than last year. Sales were up by 3.4% as a result during the 12-week period ending on August 16 compared to one year ago, according to Kantar Worldpanel. It added that the overall British grocery market saw a rise of just 0.9% compared to a year ago.

The challenge for Iceland will be to seize the moment to profitably gain market share at the expense of the major high street multiples. Sales at Tesco, for example, fell by 0.9% during the three-month period through August 16, as Britain’s top-ranked retailer now holds 28.3% of the market. Buoyant growth in the convenience stores and online has not been enough to offset lower revenues in the larger shops.

Asda has retaken its position as Britain’s second largest supermarket operator, despite a fall in sales of 2.5% and a 0.6 percentage point fall in market share (16.3%).

Waitrose saw sales rise 1.1% compared to the same 16-week period last year, while

Morrisons’ decline of 1.1% reflected a tougher comparison against 2014. Its share of market slipped by 0.2% to 10.8% overall.

Sainsbury’s is the only one of the “big four” retailers to have seen an increase in sales, which were up by 0.1% – its first growth since March. Growing slightly behind the market, the year-on-year share of the UK’s No. 3 retailer has slipped by 0.1 percentage points to 16.3%.

Iceland, which was founded by Malcolm Walker as a specialist frozen food retailer in 1970, today operates 858 stores in the United Kingdom. In addition to frozen fare, it sells chilled, fresh and other food products and drinks. The company also offers a wide range of products online; and through other stores, as well as wholesalers and partners in Europe, the Middle East and Africa. Furthermore, it exports private label and branded products around the world.

Going forward with its new majority owner, Walker commented: “Brait fully shares our belief in doing the right thing in the long term interests of our people and customers, and we look forward to working even more closely with them to build on our current strategy of innovation and improvement. Iceland celebrates its 45th anniversary in 2015, and I have never been more excited about its long term prospects as we enter this new partnership with Brait.”