Plans are said to be ahead of schedule for Lidl, the Neckarsulm, Baden-Württemberg, Germany-headquartered discount grocery chain, to open as many as 100 stores in the Unites States within a year.

The first round of ribbon cuttings, at perhaps as many as twenty 30,000 to 36,000-square-foot stand-alone units, will take place this summer in North Carolina, South Carolina and Virginia. They will feature 21,000 square feet of shopping space, which is about 35% more than Lidl’s typical outlets in Europe.

Actually, though, the company is bit behind schedule in setting up shop in the US, as the original idea was to enter the market in 2015. The plan of action was reportedly delayed due to the departure of Lidl’s chairman and head of marketing in 2014.

Meanwhile archrival Aldi, the discount chain leader in Europe, has been established in the USA since 1976 and expanding ever since. Also of German origin, the Batavia, Illinois-based Aldi Süd operation has approximately 1,600 stores in 34 states, and aims to open 600 more within the next several years. The separately owned and operated Aldi North business has 418 Trader Joe’s outlets.

Lidl’s prototype store in Spotsylvania County, Virginia, has only six aisles to streamline the shopping experience for busy customers.Worldwide Aldi has over 10,300 stores in 18 countries, while Lidl has close to 10,000 outlets in 27 countries. Aldi is currently in the midst of a $3 billion expansion program in the United States, which included the openings of 34 stores and a distribution warehouse in California during the past year. On February 8 it announced that $1.6 billion is being spent to remodel and upgrade over 1,300 existing stores by 2020.

Lidl’s prototype store in Spotsylvania County, Virginia, has only six aisles to streamline the shopping experience for busy customers.Worldwide Aldi has over 10,300 stores in 18 countries, while Lidl has close to 10,000 outlets in 27 countries. Aldi is currently in the midst of a $3 billion expansion program in the United States, which included the openings of 34 stores and a distribution warehouse in California during the past year. On February 8 it announced that $1.6 billion is being spent to remodel and upgrade over 1,300 existing stores by 2020.

Lidl has invested $77 million at its US headquarters in Arlington, Virginia, which is led by CEO Brendan Proctor. Another $120 million has gone into building warehouses in Cecil County, Maryland; Mebane, North Carolina; and Fredericksburg, Virginia.

“Through our centralized distribution, we’re able to cut down on travel costs for a shorter, quicker supply chain. Our use of presentable and mixed cases means fewer SKUs, higher turnover, and lower overhead,” reads a supplier solicitation notice on the company’s website.

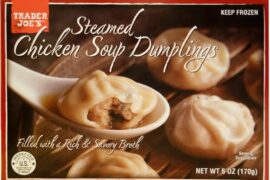

The no-frills, limited assortment retailer is big on offering private labels at low prices. Frozen products, an essential part of the mix, are found beyond Lidl’s freezer cabinets. Frozen pastries will be baked off in the bakery departments of US stores.

While Lidl may be late getting into the American grocery store competition, Kantar Retail analyst Mike Paglia is optimistic about its prospects: “Given their success in other markets, given the projections that we have for them, I think it’s safe to say that Lidl’s entrance in the United States will be one of the biggest events in US retail over the next couple of years.”