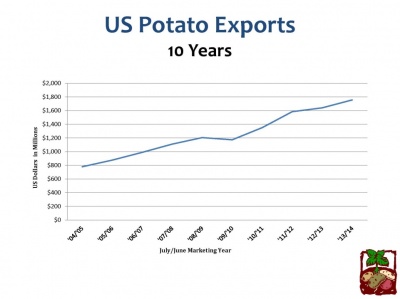

The value of all US potato exports reached $1,755,544,515 for the recently completed July 2013 – June 2014 marketing year. This is a 7% increase over the previous record set in 2012/13. The volume of exports increased 5% to 1,643,618 metric tons (MT). On a fresh weight equivalent (FWE) basis, this translates to 70,698,171 hundredweight of potatoes exported out of the United States, a 7.5% increase.

Carl Hoverson, co-chairman of the Denver, Colorado-based United States Potato Board (USPB) International Marketing Committee, noted: “This record increase in potato shipments represents 18% of US production. While most Northern Plains potato growers do not export, this volume of potatoes leaving the US market has a positive impact on all growers.”

The increase in exports was led by a 10% rise in the value of frozen potato shipments, followed by a 6% increase in dehydrated potato exports, a 6% rise in the value of fresh potato shipments, and a 4% increase in seed potato sales abroad. The only decline was a 4% drop in the value of potato chip exports.

The increase in exports was led by a 10% rise in the value of frozen potato shipments, followed by a 6% increase in dehydrated potato exports, a 6% rise in the value of fresh potato shipments, and a 4% increase in seed potato sales abroad. The only decline was a 4% drop in the value of potato chip exports.

On a fresh weight equivalent (FEW) basis, frozen potato products still account for 54% of total exports, followed by dehydrated products at 27% and fresh potatoes at 14%. Frozen and dehydrated sales have grown as a percentage of total exports at the expense of potato chips over the past five years.

The value of total potato exports has advanced by 50% in the past five years, with volume increasing by 34%. The top destination for US potato exports remains Japan (a $379 million during 2013/14), followed by Canada ($322 million) and Mexico ($235 million). Exports to Mexico grew by 18% in the past year. Korea has assumed the number four spot from China, on a volume basis, with the Philippines experiencing the largest growth, at 39%, to reach $81 million.

“These tremendous sales figures represent an outstanding return on investment to US growers from the $4 million in grower funds and $6 million in USDA international market development funds utilized to promote US potatoes and products in international markets,” stated USPB Chairman Brett Jensen, an Idaho grower.

After starting the year with losses in sales, exports of frozen potato products to Japan rebounded in the second half to end with a 3% increase in volume at 292,455 MT. Exports of frozen potato products to Mexico grew by 22% to 125,655 MT, while the volume of exports to China declined by 2% to 94,132 MT. Exports to Korea continued the solid growth pattern of the past five years with a 13% increase to 87,552 MT, while the Philippines saw a 48% advance to 50,185 MT.

“Exports are vitally important to the frozen processing industry and the growers who supply them,” emphasized USPB International Marketing Committee Co-Chairman Mike Pink. “While sales of frozen potatoes in the United States have remained relatively flat over the past 10 years, exports have grown 95% in volume and 175% in value.”

Canada retained the top spot as a destination for dehydrated exports, though there was a slight decline to 33,070 MT, while exports to Mexico grew by 4% to 23,284 MT. Shipments to Japan rebounded to 22,170 MT, an increase of 12% after a decline the previous year. Dehydrated exports to Chile have taken off with an increase of 71% this past year for a total of 6,542 MT, while exports to the Philippines have grown even more, with a 144% increase to 5,728 MT. Good growth to all top markets, except Korea and Taiwan, contributed to the overall increase of 14% in the volume of US dehydrated exports.

Exports of fresh potatoes to Canada, mainly for processing into either chips or frozen products, was off by 4%, while exports of fresh table-stock potatoes to Mexico declined 10% to 71,740 MT as a result of the increase in the price of US potatoes in 2014. Exports of fresh chipping potatoes to Korea and Japan were virtually unchanged, as both markets have reached a plateau given current market access restrictions. Exports to Malaysia were also hindered by the increased price of US spuds and strong competition from China and the EU. The best growth in exports of fresh potatoes were to the Philippines, up 42%, as the US had access to its table-stock market for the first time, and the Indonesia market was up a whopping 175%, based mainly on increases in chipping potatoes.

Exports of fresh potatoes to Canada, mainly for processing into either chips or frozen products, was off by 4%, while exports of fresh table-stock potatoes to Mexico declined 10% to 71,740 MT as a result of the increase in the price of US potatoes in 2014. Exports of fresh chipping potatoes to Korea and Japan were virtually unchanged, as both markets have reached a plateau given current market access restrictions. Exports to Malaysia were also hindered by the increased price of US spuds and strong competition from China and the EU. The best growth in exports of fresh potatoes were to the Philippines, up 42%, as the US had access to its table-stock market for the first time, and the Indonesia market was up a whopping 175%, based mainly on increases in chipping potatoes.

Looking ahead, John Toaspern, USPB chief marketing officer, commented: “World demand for potatoes and products will continue to grow at close to 10% per year in the future. However, the US will face increasing competition from the EU and China. The EU is set to have a very large crop in 2014 with extremely low prices, while China enjoys duty free access in Southeast Asia and is seeing continued expansion in frozen processing. Then again, US quality is still recognized and will result in increased export sales if prices remain competitive.”