The Polish grocery market slowed down in the first months of this year, but an improvement can be expected in the second half of 2013 in line with a general economic recovery, according to forecasts from PMR, a market research and consulting company active in over 25 countries within Central and Eastern Europe.

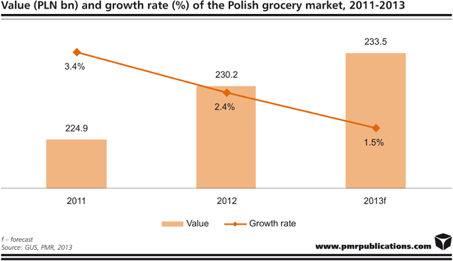

In 2013 as a whole, the Polish market for grocery products will top PLN 233bn, an increase of 1.5% compared with the year before, according to a new PMR report, “Grocery retail in Poland in 2013. Market analysis and development forecasts for 2013-2016”.

The nation’s grocery market has not gone unscathed by the global financial crisis. Although the scale of the economic slowdown in Poland was less severe than elsewhere in Europe, the downturn eventually took a major toll, cutting into incomes and consumption and affecting consumer behavior. The unstable situation weakened Poles’ purchasing power and sapped their spending optimism.

The year 2012 was largely a continuation of earlier trends. On the one hand, consumers became more price-conscious, but on the other hand, they remained unwilling to forego some of their favorite little pleasures even as they cut down on certain (non-grocery) purchases. However, the substantial deceleration of economic growth that occurred in the second half of last year, and particularly in the fourth quarter, had a direct and adverse impact on the grocery market, with many retailers (especially in the hypermarket segment) recording declines in revenues. The negative impulses persisted through the first half of 2013.

This was due to the cumulative effect of several factors. First, the Polish economy suffered from a deterioration of external conditions. Second, as the economic outlook grew increasingly uncertain, consumers felt a greater urgency to save money. And third, the cost of living has been going up, which in a context of stagnant real incomes led to a fall in consumer spending.

A PMR survey carried out in July 2013 showed that fully 67% of adult Poles thought their spending on grocery items had increased as compared with a year earlier, with one in three describing the increase as significant. In the previous wave of the survey, conducted in October 2012, the percentages were 72% and 45%, respectively. This indicates that growing expenditures on necessities remain a big problem.

As a result, Polish consumers are becoming increasingly deliberate and thoughtful in their purchases, trying to manage their budgets in a rational way. One in two respondents in this year’s survey said that they had changed their buying habits in the recent past, and one in three admitted that while they bought similar quantities than a year ago, they were paying more attention to prices.

Retailers are taking note of these trends. They are increasingly building their long-term promotional campaigns around low prices, and are giving more importance to private label products, which are highly popular among consumers due to attractive prices.

In the early part of 2013 many retail chains recorded declines in sales revenues. Sales at Tesco, for example, slumped by over 8% in the first quarter. The slowdown eventually caught up even with Biedronka. While the discounter managed to keep its second quarter sales growth in positive territory, like-for-like sales were up by a meagre 2%, the worst result in a long time. The situation can be expected to improve towards the end of 2013, but the growth rates will not significantly exceed levels seen in recent years. According to PMR forecasts, in 2013 as a whole the market will grow by just 1.5%, to PLN 233.5bn.

The pace of the recovery is set to be slow as no significant positive stimuli are expected in the coming years, though new investments financed from the EU’s 2014-2020 budget and resilient exports will, among other factors, protect the Polish economy from recession. Also, after a period of belt-tightening, spending on certain purchases can be expected to start growing again. According to the forecast, in the years ahead the market will grow by about 3% a annually.