Last year, despite difficult potato growing conditions due to extreme heat and drought, increased production of frozen fries again powered growth for the Belgian potato processing industry. Prospects this year, however, are not looking good due to the devastation of viral infection. No, not the dreaded PVY strain that causes necrosis in tubers or the PLVR potato leaf rolling virus, but instead the more dreaded novel coronavirus (SARS-CoV-2) contagion that has spread from Wuhan, China to cause death and disruption worldwide.

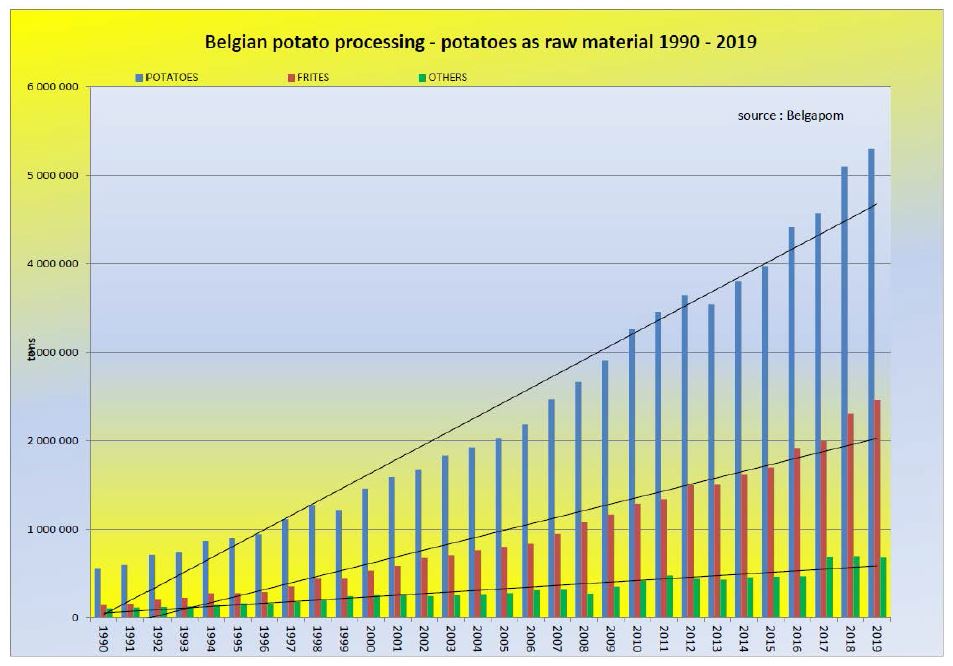

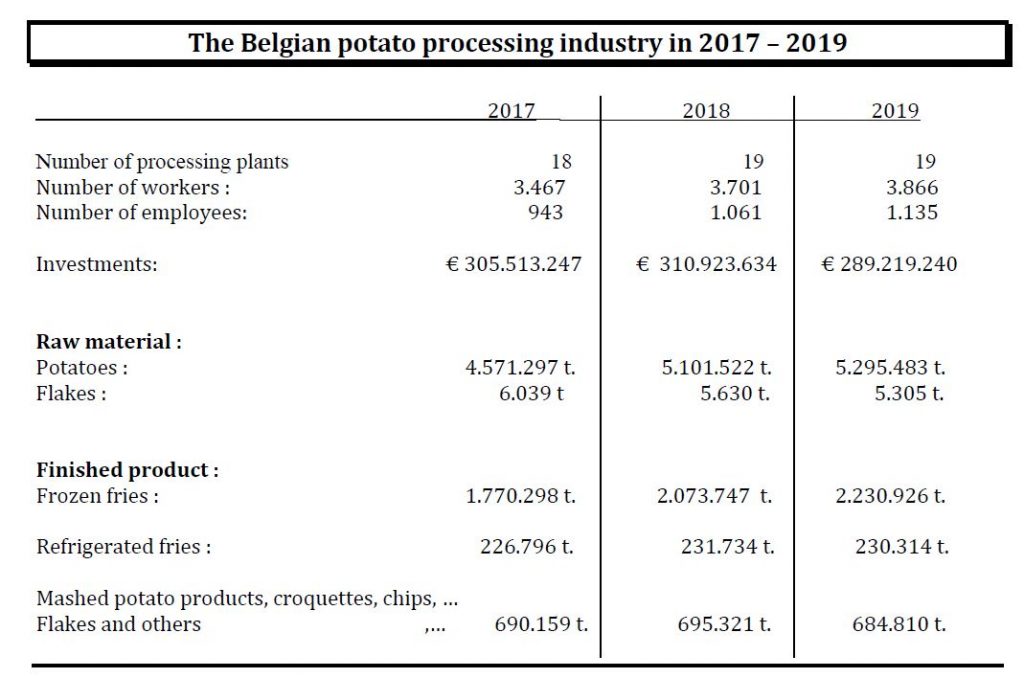

First, let’s review the positive report of yesteryear’s positive performance. According to Belgapom, the Berlare-based Belgian potato trade and processing association, in 2019 almost 5.3 million tons of potatoes were transformed into fries, mashed potato products, crisps, flakes and granules of precooked spuds. That amounted to an increase of 3.8% compared to 2018 figures.

Last year, 2,231,000 tons of frozen fries were produced (up 7.5% compared to 2018). The production of non-frozen fries (230,314 tons) and other potato products (684,810 tons) fell slightly by 0.5 and 1.6 % respectively.

Rise in Employment, Investment, Exports Tonnage and Value

The number of employees working in the sector rose from 4,762 to 4,991 last year. Investments amounted to €289,219,240. Frozen fries dominated exports, with shipments of 2,680,086 charting an increase of 8.1% compared to 2018. The value was €1,935,181 million, up 18.2 % more than the previous year. This increase due in part to the higher prices of raw materials, since 2019 was in the middle of two difficult growing seasons as a result of extremely hot and dry summers.

What is remarkable about the above statistics is that Belgium is the only country in Northern Europe that showed an increase in exports during 2019, according to Belgapom.

Now, the Bad News

While the prospect for the 2020 had been positive, all has changed with the negative impact the coronavirus pandemic, which has brought the shutdown of QSR restaurants, snack bars and other foodservice outlets across Europe and much of the world as governments have significantly curtailed the freedom of movement of their citizens in an effort to curb the further spread of the killer bug.

Among much negative economic fallout following the outbreak of SARS-CoV-2 and subsequent unleashing of deadly Covid-19 respiratory disease in Central China late last year and well past the conclusion of the Lunar New Year holiday period in Asia was a huge backload of containers not being unloaded in Chinese ports. This led to logistical problems for European potato exporters, as well as many other food trading industries.

Then, come mid-March, reported Belgapom: “The virus started to appear everywhere in Europe and local authorities proceeded with lockdowns. The problems kept mounting in the potato sector. Restaurants and professional kitchens closed, and after a short period of hoarding the fall in demand in supermarkets became noticeable. At the beginning of April, the same approach was rolled out all over the world, so that the export of frozen products faced problems…No one knows how long this situation will drag on. The near future is one big question mark. However, it is already clear that the coronavirus will really lay into the 2020 figures of this dynamic sector.”

Noting that there is currently a surplus of approximately more than a million tons of potatoes in the Netherlands, Romain Cools of Belgapom estimates that Belgium’s surplus will likely be in a similar range. As cold storage warehouses fill up with unsold value-added potato products, there is no place to store new output. As such, new production is being drastically curtailed.

Philippe Debruyne of Aviko, the Dutch potato processing company that ranks as the fourth biggest producer in the world, recently commented: “Our fries production is partly at a standstill. We will continue to make the other potato specialties, but at a slower pace because our employees have to work at a safe distance from each other.”

According to a recent NRC.nl report, Dutch potato growers have a mountain of approximately 1.5 million tons of tubers on hand, of which two-third cannot be sold. While they are reaching out to the European Union for support, thus far none has been forthcoming.

“Corona is impacting all sectors. Brussels is not going to regard this as a priority,” said Carola Schouten, Minister of Agriculture, Nature and Food Quality in the Netherlands.