According to Frozen Foods in the US: Hot Meals, Sides and Snacks, a recent report from market research publisher Packaged Facts, American consumers are slowly warming up again to frozen foods due to the well-known convenience of such products and the recent introduction of more natural and organic offerings that are lending the segment a health halo. Consumer concerns about preservatives and other added ingredients are alleviated by the notion that if the products are natural or organic, they must be fresher or healthier.

“Frozen foods of all kinds have been challenged in recent years as a result of the convergence of several trends, especially, but not exclusively, a growing demand for fresh products or, at least, fresher products in refrigerated rather than frozen form. Nevertheless, frozen food products still have much to offer,” said David Sprinkle, Packaged Facts’ research director. “For instance, frozen products identified as natural or organic are having a more positive experience than frozen foods in general. These organic and natural frozen foods appeal to the consumer who is both cost conscious and health conscious.”

Looking ahead, the future of the frozen foods segment is encouraging after several years of flat or slowly declining sales at the retail level. Packaged Facts notes that total dollar value fell by about one percent in both 2013 and 2012, and was essentially flat last year. It estimates that sales of the collective frozen food categories dinners/entrées, pizzas, side dishes, and appetizers/snacks will edge up from $22 billion in 2014 to $23 billion in 2019.

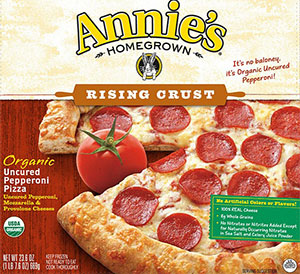

In addition to the continued emergence of natural/organic frozens, increased sales of frozen dinners/entrées, pizzas, side dishes and snacks in the upcoming five-year period will be based on the ability of major marketers to adjust to a changing consumer environment that calls for more variety (in terms of flavors and serving styles), healthier ingredients, and better pricing. Another factor will be increased growth among smaller brands like Annie’s (now part of General Mills), which should attract more customers for its natural and organic frozen dinners and entrées.

In addition to the continued emergence of natural/organic frozens, increased sales of frozen dinners/entrées, pizzas, side dishes and snacks in the upcoming five-year period will be based on the ability of major marketers to adjust to a changing consumer environment that calls for more variety (in terms of flavors and serving styles), healthier ingredients, and better pricing. Another factor will be increased growth among smaller brands like Annie’s (now part of General Mills), which should attract more customers for its natural and organic frozen dinners and entrées.

Scope and Methodology

Market estimates within the report were based on both public and syndicated data sources. Packaged Facts has analyzed available sales and trend data, together with information pertaining to those products that move through unmonitored outlets, to estimate the total size of the market for the products in the categories under consideration.

Sales and market size data sources include:

- IRI sales tracking through US supermarkets and grocery stores, drugstores, and mass merchandisers (including Target, Kmart, and Wal-Mart) with annual sales of $2 million or more

- US Census Bureau retail food sales data from the Economic Census surveys, annual retail channel sales, and non-employer statistics

- US Bureau of Economic analysis annual estimates for consumer spending by food type

- Major food and beverage retailer annual reports for individual retailer sales

- Publicly available data from other industry sources including trade associations and print and online publications

Packaged Facts also drew on a proprietary national online consumer survey conducted in July and August of 2014.

Information on new product introductions was derived from examination of the retail milieu and from relevant trade, business, and government sources, including company literature and annual reports.

The report, which sells for US $3,995, is available by contacting the Rockville, Maryland, USA-headquartered publisher:

Phone: +1 240-747-3095

Fax: +1 240-747-3004

E-mail: customerservice@packagedfacts.com