Tortola, BVI-headquartered Nomad Foods Limited has completed its acquisition of London-based Findus Sverige AB and its subsidiaries from LionGem Sweden 1 AB, a company backed by a group of investors including Highbridge Principal Strategies, Lion Capital LLP and Sankaty Advisors, for approximately £500 million. The acquisition includes Findus Group’s continental European businesses in Sweden, Norway, Finland, Denmark, France, Spain, and Belgium, as well as the intellectual property and commercialization rights to the Findus, Lutosa and La Cocinera brands in the respective markets. The acquired operations include approximately 1,500 employees and six manufacturing facilities.

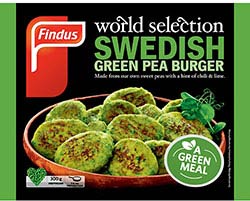

Through this transaction, Nomad has extended its position as the largest frozen food company in Western Europe, with leading market share in nine countries (UK, France, Sweden, Germany, Italy, Austria, Belgium, Portugal, and Spain). The acquisition reunites Nomad’s existing Findus-branded business in Italy with the brand in other key geographies, strengthening overall presence across the European continent. Including the acquired Findus businesses, Nomad employs over 4,300 people in 15 countries, with 10 factories, and a broad portfolio of product offerings. This scale and reach will help the company execute on its innovation strategies while using consumer insights to tailor its offering for local markets.

Stéfan Descheemaeker, Nomad’s chief executive officer, stated: “The complementary nature of our footprint and the strength of our combined brands across Europe significantly enhance Nomad’s scale and competitive offering. The Birdseye, Iglo, and Findus brands have played key roles in defining the frozen food category over the past decades, and together will be better positioned to continue bringing fresh and ‘better-for-you’ meal options to consumers across Europe.”

Stéfan Descheemaeker, Nomad’s chief executive officer, stated: “The complementary nature of our footprint and the strength of our combined brands across Europe significantly enhance Nomad’s scale and competitive offering. The Birdseye, Iglo, and Findus brands have played key roles in defining the frozen food category over the past decades, and together will be better positioned to continue bringing fresh and ‘better-for-you’ meal options to consumers across Europe.”

Nomad’s co-founders and co-chairmen, Noam Gottesman and Martin E. Franklin, jointly remarked: “The closing of this acquisition demonstrates our ability to successfully execute against our defined strategy. Bringing these businesses together will yield substantial synergies, which we intend to re-invest in our ongoing growth and expansion. As we work to build a best-in-class global consumer foods company, we are encouraged by the opportunity set and remain focused on creating value for all of our stakeholders.”

The cash consideration of £400 million was funded through a combination of existing cash on hand and a new senior term loan. At closing, Nomad’s net debt to adjusted EBITDA ratio is approximately 3.7X. Additionally, the Seller has been issued approximately 8.4 million ordinary shares in the capital of Nomad (the “Shares”), representing approximately 5% of the issued ordinary share capital of Nomad. The seller is restricted from transferring any of the shares before November 2, 2016, and is restricted from transferring more than 50% of the shares before November 2, 2017.

Nomad Foods Ltd has now set its sights on bargain buys in the United States, according to a Reuters dispatch. Having made a binding offer to acquire continental Europe frozen food operations of the Findus Group for £500 million ($781 million) on August 13, after purchasing Iglo Foods Holdings (including the iconic Birds Eye brand) for EUR 2.6 billion ($2.9 billion) in June, the Tortola, British Virgin Islands-headquartered investment vehicle appears to be rolling its way to fresh pastures for capital deployment on the other side of the Atlantic.

Nomad Foods Ltd has now set its sights on bargain buys in the United States, according to a Reuters dispatch. Having made a binding offer to acquire continental Europe frozen food operations of the Findus Group for £500 million ($781 million) on August 13, after purchasing Iglo Foods Holdings (including the iconic Birds Eye brand) for EUR 2.6 billion ($2.9 billion) in June, the Tortola, British Virgin Islands-headquartered investment vehicle appears to be rolling its way to fresh pastures for capital deployment on the other side of the Atlantic.

Meanwhile, Nomad Foods Descheemaeker continues to seek out and buy what CEO Descheemaeker “neglected frozen food brands.” It has reportedly been actively prospecting in the USA for the past four months or so to target acquisitions.

Nomad was launched as an acquisition vehicle in 2014 by billionaires Gottesman (founder and ceo of TOMS Capital) and Franklin (co-founder and chairman of Jarden Corp., a diversified consumer products company with annual sales of over $8 billion). Fellow billionaire investor William A. Ackman, who manages the New York-based Pershing Square Capital Management hedge fund, acquired a 19.6% voting rights stake by buying 33,333,334 ordinary shares of Nomad Foods Limited stock on July 14.

In a presentation to investors over the summer, Nomad Foods spelled out that it is looking for leading companies in niche markets with strong management organizations in place. Additionally, acquisition candidates must have a long history of strong free cash flow generation and attractive valuation against cash flows. This was the criteria and approach in targeting both Iglo Group and Findus assets.

“Numerous opportunities exists across the US and Europe to increase footprint in frozen foods,” states the company’s presentation. “Nomad Foods is well positioned to lead broader food consolidation and build a best in class global foods company.”