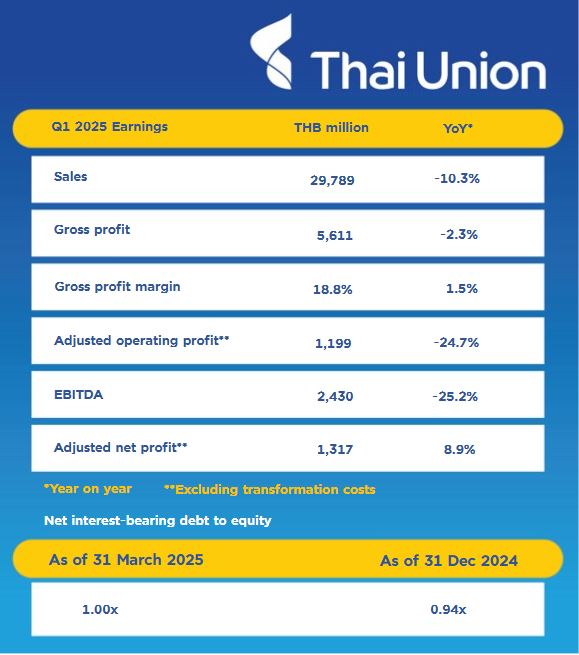

The Thai Union Group PCL reported a 10.3% decline in sales to THB 29.8 billion for the first quarter of the year, due to a 6.9% decline in organic sales growth, softer ambient, frozen and value-added categories, and a stronger Thai Baht against key currencies. Continued cost discipline helped maintain a healthy balance sheet, with the Bangkok-headquartered company’s gross profit margin rising to 18.8% – a record for the first quarter.

In Q1 2025, net profit, excluding transformation costs associated with the implementation of Strategy 2030 – Thai Union’s roadmap to deliver strong growth and transform the group into the world’s leading marine health and nutrition company, increased by 8.9% year-on-year to THB 1.3 billion. The net profit was reported at THB 1 billion, and a solid net-debt-to-equity ratio was maintained at a healthy 1.0x.

“Despite a challenging macro backdrop, we continued to strengthen our core businesses, invest for long-term growth and deliver healthy profitability,” said CEO Thiraphong Chansiri. “When embarking on our transformation journey, we knew increasing our agility, efficiency and speed was essential. In today’s world that is never more true. We have laid solid foundations, which are now serving us well and delivering value which will only increase further in the future.”

The frozen seafood business saw sales decline 12.2% year-on-year at THB 8.4 billion because of softer shrimp sales impacted by an exceptional increase in prices in the United States. Frozen GPM improved to 12.4% from 11.8% a year earlier. Sales in the value-added decreased 3.1% year-on-year to THB 2.4 billion.

The PetCare business continued to grow in the first quarter, with sales increasing 5.5% year-on-year to THB 4.2 billion while its gross profit margin was 24.5%. Ambient sales fell 14.0% to THB 14.7 billion from a year earlier due to a high baseline last year with exceptional demand from the Middle East, and a decline in private label sales across Europe as customers delayed purchases amid rising fish prices. The GPM for Ambient stood at 19.4%.

With the global business environment remaining volatile, Thai Union continues to closely monitor and assess the potential impact on the group if the US Government implements reciprocal tariffs rates. Thai Union has anticipated the tariff changes and proactively built-up inventory across all categories in the United States, with 4-6 months of sales in finished goods currently in the market, mitigating short-term risk. The company continues to leverage its global processing and sourcing footprint to minimize potential disruption from the tariffs. With 15 processing facilities in 13 countries including Ghana, Seychelles, Poland, the United States and Vietnam. Thai Union is well positioned to react to any potential developments in the tariff environment.

In the first quarter, the Japan Credit Rating Agency (JCR) affirmed Thai Union’s foreign currency issuer credit rating at A with a stable outlook due to its strong brand power and high earnings stability. The credit rating is the same level as the sovereign credit rating of Thailand from JCR. The local currency long-term issuer credit rating by JCR was also assigned at A with a stable outlook.

Blue Loan to Advance Sustainable Shrimp

In other financial news, meanwhile, Thai Union has secured a landmark US $150 million Blue Loan from the Asian Development Bank (ADB), the first-ever loan of its kind by the multilateral bank to a seafood company in Thailand. Proceeds will be used to expand sourcing of shrimp certified under schemes recognized by the Global Sustainable Seafood Initiative (GSSI), including the Aquaculture Stewardship Council (ASC) and Best Aquaculture Practices (BAP), or procured from farms engaged in credible Aquaculture Improvement Projects (AIPs). The approach emphasizes both environmental sustainability, such as biodiversity protection, feed traceability, and lower carbon emissions from the use of renewable energy, improved FCR, and preventing deforestation, along with social responsibility, including fair labor practices and community engagement.

“Sustainability sits at the heart of our business, and this Blue Loan represents an important step in our journey,” said CEO Thiraphong Chansiri, “We are honored to be ADB’s first private sector partner in the seafood industry in Thailand, and the first in the seafood industry to secure a loan of this kind. The funding will accelerate our sustainable sourcing efforts and strengthen our contribution to ocean health, food security and climate action. We hope this model will inspire other seafood companies to follow.”