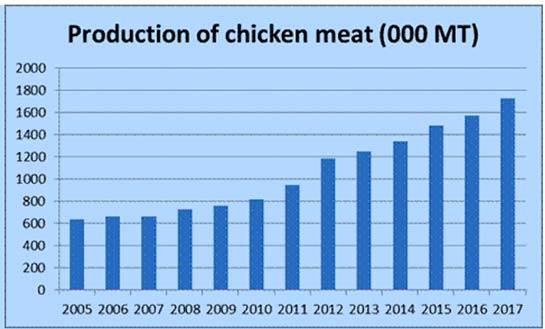

Poland remains the major producer of poultry meat in the European Union, with production in 2016 estimated to increase by an additional 15 percent in comparison to 2015, according to a GAIN report issued on December 9 by the USDA Foreign Agriculture Service. Highlights of the report, written by Warsaw-based agricultural specialist Piotr Rucinski, are detailed below.

In 2015 Polish poultry production amounted to 2,386,000 metric tons (MT), or seven percent higher than in the previous year. The increase stemmed from growing domestic consumption (as consumers substituted beef with poultry, which is less expensive to buy and perceived as healthier meat to eat), and increasing exports, mainly to other EU member states. Poultry meat production consisted mainly of chicken broilers (81%); turkey broilers (14%), which are in demand for the domestic meat processing industry; and ducks and geese, which are sold mainly in Germany and other countries in Western Europe.

A low level of prices for compound feeds and continuing demand for exports stimulated poultry meat production in 2016. It is estimated that output increased by an additional 15% in comparison to 2015. However, it is forecast that due to the reduction of prices for poultry meat on the domestic market, coupled with declining export demand, production expansion for poultry meat in the first half of 2017 will slow down to seven percent compared to the same period of 2016.

Consumption

It is estimated that in 2016 annual consumption of poultry meat will amount to 28.5 kilograms per capita, almost five percent higher than in 2015. Poultry remains the cheapest meat on Polish market, which stimulates consumption. Since 2013 there has been a trend toward lower retail prices for poultry meat. In 2015 retail prices declined by four percent in comparison to 2014, and in the first eight months of 2016 they fell by additional 1.6 percent in comparison to the same period of 2015.

Although pork remains the most preferred meat for Polish consumers, who consume 40 kilograms per capita, poultry meat is increasingly perceived as a healthy and cheap alternative. Meanwhile, the Polish meat processing industry specializes the in production of poultry sausages and pates which imitate pork products

It is forecast that in 2017 poultry consumption will increase by an additional two percent because of higher production and a decrease in retail prices. Poultry meat constitutes 38% of total meat consumption in Poland, compared to 55% for pork and only two percent for beef. It is estimated that consumption of poultry from backyard production amounts to 6.5% of total poultry meat production.

Trade

In 2015 export of Polish poultry meat amounted to 698,970 MT, which was 20% higher than in 2014. However, the sales value amounted to US $1.3 billion, almost the same as in 2014, which reflected a drop of export prices. It is estimated that in 2015 some 30% of Poland’s poultry meat production was destined for foreign markets, and it is expected that exports will have grown in 2016 because of continued demand from buyers in the EU and Asia. The major destinations of Polish poultry meat within the EU are the UK, France, Germany, the Netherlands and the Czech Republic. Outside of Europe exports go primarily to Hong Kong, China and the Congo.

The Polish poultry meat industry is highly integrated and export oriented. Although the majority of sales occur in the internal EU market, the industry and Polish government are trying to open new markets. Toward this end, it is working to obtain eligibility to export to the United States.

Imports of poultry meat are stable and consist mainly of chicken and turkey cuts bought from suppliers in Germany, the UK and Hungary. In 2015 the value of imports amounted to US $76 million, a two percent rise in comparison to 2014 because of increased purchases of frozen chicken cuts and edible offal from Slovakia.